Bitcoin Boom

In a recent Forbes article, an experienced financial writer takes a fresh look at the future of blockchain, sparking discussion with his predictions and the controversial use of chart analyses. While some argue that charting is unreliable—since past patterns aren't always a crystal ball into the future—the author makes an interesting point that not all markets are completely unpredictable. Some, like Bitcoin, show a kind of predictable randomness, which might just offer clues about what’s next.

As we step into 2024, Bitcoin is once again turning heads by shattering its previous record of $69,000 from November 2021. This resurgence in March has sparked a flurry of bold forecasts. Figures like Kiyosaki are stepping up on social platforms like X, predicting that Bitcoin could hit a staggering $300,000 by the end of 2024. Kiyosaki, who has long championed alternative assets as a hedge against economic instability, reflects a growing optimism among investors.

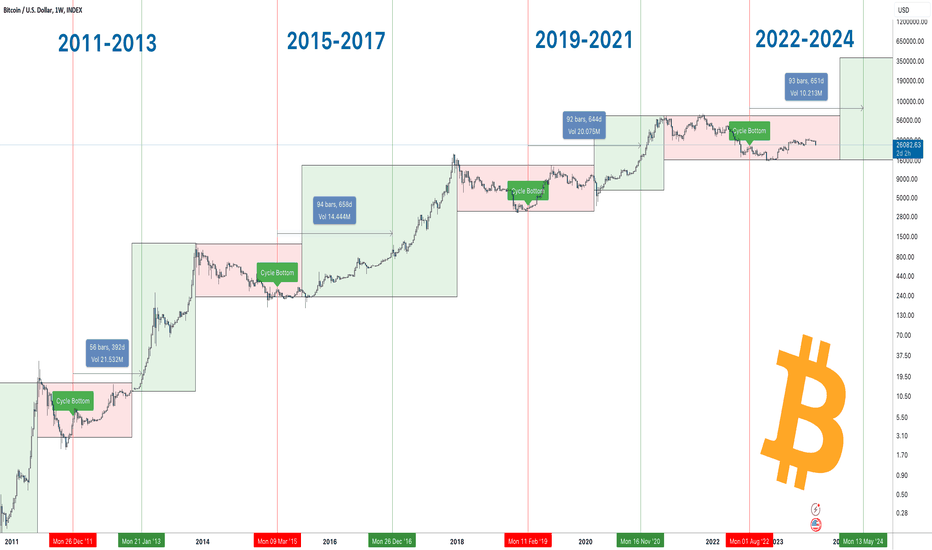

These projections range wildly, with some predicting Bitcoin could reach anywhere from $100,000 to $500,000. But we've seen this pattern before—sharp spikes in Bitcoin’s price in years like 2013, 2017, and 2021 were often followed by dramatic drops. This begs the question: are we simply gearing up for another round of extreme highs and lows, or could this surge be the start of something more stable?

This narrative captures the excitement and uncertainty in the world of cryptocurrency, inviting readers to consider whether we're on the brink of a new era in digital finance or just another speculative bubble.

Bitcoin Bust - Every Parallel Patterns Ever

Bitcoin's rollercoaster ride continues, as evidenced by its recent surge followed by a swift downturn. Just after reaching a peak on Tuesday, Bitcoin experienced a significant dip, with its value dropping by over 14%. This pattern of sudden price jumps followed by sharp declines is all too familiar for Bitcoin investors, reminiscent of the cycles seen in 2013, 2017, and 2021, and at various points in between. These fluctuations typically lure investors back into a boom-and-bust cycle, where the excitement of potential gains often ends in financial pain.

Despite this volatility, the die-hard believers never cash out their Bitcoin, riding through the highs and lows with unwavering commitment. On the other hand, some investors, perhaps motivated by a fear of missing out (FOMO), rush to buy during a spike, only to see the value plummet shortly thereafter. "Bitcoin from the earliest days has been very volatile," observes David Yermack, a professor of finance and business transformation at New York University's Stern School of Business, capturing the essence of Bitcoin's unpredictable nature.

Interestingly, while it's tempting to predict the next drop following a surprising rise, Bitcoin continues to defy easy predictions. Past crashes have been triggered by a variety of factors—regulatory actions, security breaches, product failures, or simply the bursting of speculative bubbles. Recently, the introduction of Bitcoin ETFs sparked a new rally, but this could also lead to its undoing. If investors begin to withdraw, the funds might sell off their holdings, turning what was an upward spiral into a rapid descent. This pattern underscores the complex dynamics at play in the cryptocurrency market, where each rally could potentially sow the seeds of the next major downturn.

Are You In, Or Out Of This Game?

To be honest, the answer is still quite unclear.

Truth be told, the waters are still pretty murky.

But then again, when has the Bitcoin journey ever been crystal clear?

So, how should we approach strategy in these unpredictable times? Are we chasing the thrill, swept up in the fear of missing out, or should we be the voice of reason, urging a moment of pause?

- Think of investing like dating—take your time to understand the intricacies. What draws you to it? What are the risks? How much are you truly ready to risk?

Consider the advice to dive deep into research, stay alert to trends, and note patterns that could give you an edge in the future. Knowing the crypto scene thoroughly is essential before making your move. Remember the crypto rollercoaster of 2021, which soared to new heights only to plummet in 2022 as the reality behind some major firms unraveled, leaving many investors out in the cold.

Here's a valuable piece of advice: don't put all your eggs in one basket—or in this case, the Bitcoin basket. The world of digital currencies is vast with many other emerging options. Alternatively, consider traditional investment channels like stocks, bonds, real estate, and gold. These might not promise quick riches, but as Warren Buffett famously advised, the first rule of investment is not to lose money, and the second is to never forget the first rule. Diversifying helps you minimize losses and steadily work towards your financial goals, even if the progress seems slow.

So, what's my take on whether you should join the Bitcoin craze? As I finish writing this, I've added Bitcoin to my investment portfolio, believing in its long-term potential.

However, I'm playing it safe—no putting all my funds in it and avoiding leverage. I'm prepared to hold long-term if necessary.

Now, what about you? Are you ready to board the Bitcoin train?